The Smart Card Market is growing steadily, fueled by rising demand for secure, contactless transactions, identity verification, and data storage across banking, telecom, and healthcare sectors.

Austin, April 16, 2025 (GLOBE NEWSWIRE) -- Smart Card Market Size & Growth Insights:

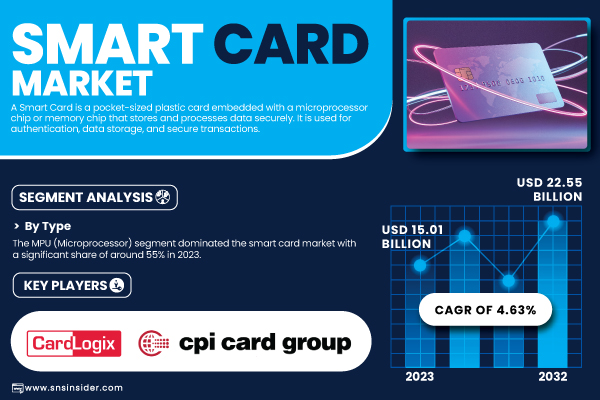

According to the SNS Insider,“The Smart Card Market Size was valued at USD 15.01 billion in 2023 and is projected to reach USD 22.55 billion by 2032, growing at a CAGR of 4.63% from 2024 to 2032.”

Smart Card Market Set for Strong Growth Driven by Security Needs and Digital Innovation

The smart card market is undergoing significant transformation, fueled by growing cybersecurity concerns, rapid technological advancements, and the demand for secure digital solutions across diverse sectors. With rising threats to digital infrastructure, financial institutions and enterprises are increasingly adopting smart cards for enhanced security and operational efficiency. In the U.S. market, the value was USD 2.68 billion in 2023 and is expected to grow to USD 4.36 billion by 2032, at a CAGR of 5.55%, Innovations such as biometric authentication, multi-factor verification, and contactless technology are becoming standard features.

Get a Sample Report of Smart Card Market Forecast @ https://www.snsinsider.com/sample-request/6290

Leading Market Players with their Product Listed in this Report are:

- Block, Inc. (USA): Square Payment Solutions, Square Reader, Square Terminal

- CardLogix Corporation (USA): Smart Cards, EMV Solutions

- CPI Card Group Inc. (USA): EMV Cards, Prepaid Cards

- Giesecke+Devrient GmbH (Germany): SIM Cards, Mobile Security Solutions

- HID Global Corporation (USA): Identity Management, Access Control Solutions

- IDEMIA (France): Biometric Solutions, Secure Identity Products

- INTELIGENSA (Mexico): NFC Payment Solutions, Smart Cards

- Samsung Electronics Co., Ltd. (South Korea): Biometric Authentication, Mobile Security Solutions

- Sony Corporation (Japan): RFID Tags, Smart Cards

- Thales (France): Payment Cards, Data Security Solutions

- Gemalto (Amsterdam, Netherlands): (Smart Cards, Digital Security Solutions)

- IDEMIA (Courbevoie, France): (Smart Card Solutions, Biometric Security)

- NXP Semiconductors (Eindhoven, Netherlands): (Smart Card ICs, RFID Solutions)

- Infineon Technologies (Neubiberg, Germany): (Smart Card Chips, Security Solutions).

Smart Card Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 15.01 Billion |

| Market Size by 2032 | USD 22.55 Billion |

| CAGR | CAGR of 4.63% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Memory, MPU Microprocessor), By Interface(Contact, Contactless, Dual Interface), By Functionality(Transaction, Communication, Security & Access Control) • By Application(BFSI, Telecommunication, Government & Healthcare, Retail & E-commerce, Transportation, Others) |

| Key Drivers | • Transforming through innovations in security, technology, and diverse sector applications. • Biometric integration in smart cards, including fingerprint and facial recognition, is revolutionizing security, with the financial sector driving adoption. |

In the UK, for example, 123 million out of 159 million debit and credit cards now support contactless payments. The adoption of smart cards is also expanding into public transport and urban mobility systems, as seen in Miami’s 2023 launch of a contactless open fare payment system. Additionally, the market is witnessing convergence with blockchain and cryptocurrency applications, with firms like CardLab and eSignus pioneering secure smart card-based digital asset management. This evolution highlights smart cards' growing role in enabling secure, convenient, and future-ready digital ecosystems.

Smart Card Market Sees Diverse Growth Across Type, Interface, Functionality, and Application Segments from 2023 to 2032

By Type

In 2023, the MPU (Microprocessor) segment held the largest share of the smart card market at around 55%, owing to increasing demand for secure, high-performance, and versatile solutions spanning finance, healthcare, and telecommunications. These smart cartons provide greater exclusive features such as encryption, hierarchical registration, and layered management, which find themselves in mission-level applications such as payment, access control, and identity.

The memory segment is expected to be the fastest-growing from 2024 to 2032, driven by demand for smartphones with higher storage for supporting advanced functions in industries such as banking, healthcare, government.

By Interface

The contactless segment led the smart card market in 2023, accounting for approximately 59% of revenue, due to increasing consumer preference for faster, more convenient and secure payment modes. Those cards are also suitable for tap-and-go transactions, which can be ideal for high-traffic environments, such as in retail and public transport. The simplicity of use complemented by improved security has spurred mass adoption.

The dual interface segment is projected to be the fastest-growing from 2024 to 2032, owing to the increase in demand for cards with support for contactless as well as contact-based applications. This accelerated adoption is driven by their versatility, security, and suitability for multi-purpose application within banking, transit, and ID verification.

By Functionality

In 2023, the communication segment held the largest revenue share of around 55% in the smart card market, driven by its critical role in applications such as mobile payments, telecommunications, and secure access control. The surge in demand for seamless and secure data exchange, powered by technologies like NFC and Bluetooth, has made communication-enabled smart cards essential across various industries.

The transaction segment is projected to grow the fastest from 2024 to 2032, fueled by the global shift toward digital payments. Rising adoption of contactless payments, mobile wallets, and online transactions is driving demand for smart cards that offer secure and efficient financial operations.

By Application

In 2023, the telecommunication segment led the smart card market with a 40% revenue share, owing to the necessity for secure communication and data storage in SIM cards and user authentication of subscribers. With the increasing growth of mobile networks and the advent of technologies such as 5G and IoT, smart cards continue to be an essential element to safely run telecom infrastructure.

The BFSI segment is expected to be the fastest-growing from 2024 to 2032, driven by rising demand for secure digital banking, contactless payments, and biometric authentication. Smart cards are increasingly used in infrastructure development and financial services, supporting secure transactions and efficient service delivery in a rapidly digitalizing world.

Do you Have any Specific Queries or Need any Customize Research on Smart Card Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/6290

Smart Card Market Leadership and Growth Trends in APAC and North America

In 2023, the Asia-Pacific (APAC) region held the largest revenue share in the smart card market at approximately 40%, to the rapid adoption of smart cards by various end users including telecommunications, banking, and transportation. Countries like China, India, and Japan leading in the adoption of smart cards for secure transactions and identity verification, fuelled by robust government initiatives in public services like healthcare and transit. Market growth has also been bolstered by increasing urbanization and demand for contactless solutions.

North America is projected to be the fastest-growing region from 2024 to 2032, fueled by increasing demand for secure, contactless payment systems, identity verification, and digital banking. The region is witnessing rapid smart card adoption in banking, healthcare, and transport, especially in the U.S. and Canada, where innovation in fintech, mobile wallets, and biometric authentication is accelerating. This trend highlights a strong push towards enhanced security and digital efficiency in both regions.

Recent Development

- 28 Nov 2024, Infineon's Meng-Hui Ng highlights how the company is advancing contactless payment technology to meet rising global demand for secure, fast, and user-friendly transactions

- November 1, 2024, NXP Semiconductors will showcase key security trends for industrial and IoT markets at electronica 2024, focusing on compliance with regulations like the upcoming Cyber Resilience Act.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption

5.2 Regulatory and Compliance Factors

5.3 Emerging Trends

5.4 Consumer Behavior

6. Competitive Landscape

7. Smart Card Market Segmentation, by Type

8. Smart Card Market Segmentation, by Interface

9. Smart Card Market Segmentation, by Functionality

10. Smart Card Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Biometric System Industry Analysis Report

Smart Badge Industry Analysis Report

RFID Readers Industry Analysis Report

Wearable Payment Device Industry Analysis Report

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)